A Look Inside China’s Innovative Drug Applications

In this article, learn how regulatory reforms have contributed to the recent boom in China’s new drug R&D activities, with the number of investigational new drug applications (INDs), new drug applications (NDAs) and clinical trials approvals increasing each year.

Since July 22, 2015, China’s National Medical Products Administration (NMPA) has carried out a series of regulatory reforms that are starting to accelerate clinical development and regulatory review of China’s innovative drugs.

The number of investigational new drug applications (INDs) and new drug applications (NDAs) has increased year over year. In the first quarter of 2022, according to an analysis by experts from the PPD™ clinical research business of Thermo Fisher Scientific, the number of IND and NDA approvals in China reached their highest in five years.

At the same time, more local Chinese biotech companies are now involved in the research and development of innovative first-class drugs (innovative drugs that are not marketed domestically or abroad) and are pursuing a global R&D footprint.

Here are five key quantitative and qualitative changes arising from new drug R&D activities in China, derived from our analysis.

1. The INDs are primarily first-class drugs. Half of the approved INDs were entirely new drugs.

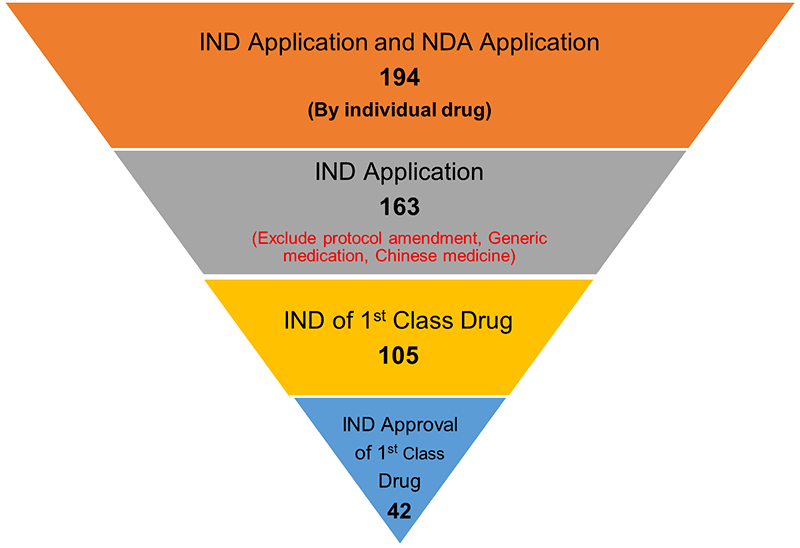

In the first quarter of 2022, the NMPA received a total of 194 IND and NDA applications. INDs made up 163 of the applications, with 63% as first-class new drug applications.

2. The IND applications are mainly for oncology treatment drugs.

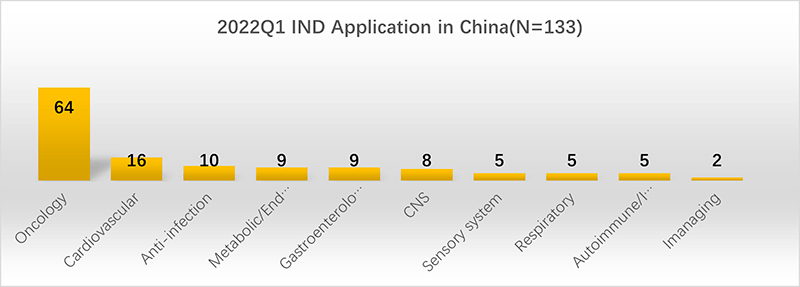

Among the 164 IND applications, 133 reported the therapeutic area, and many (39%) consist of oncology treatment-related drugs, which is consistent with global R&D trends. The second tier consists of drugs for cardiovascular diseases, and the third tier consists of drugs for anti-infection treatment.

3. The number of first-class drug INDs approved by domestic companies is higher than that of multinational companies.

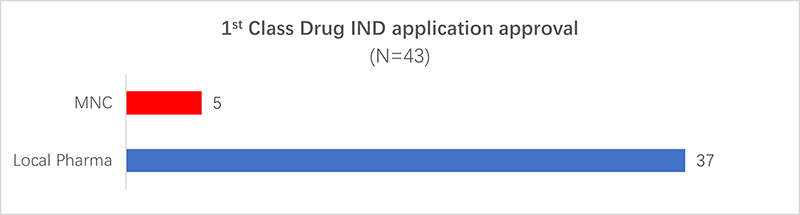

Out of the IND application approvals for first-class new drugs in the first quarter of 2022, 37 were from domestic Chinese companies and 5 were from multinational companies.

This demonstrates that local companies are likely to play an increasingly important role in supporting the development of new drugs in China in the coming years.

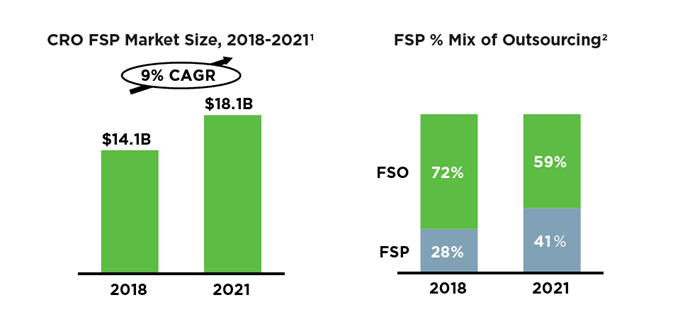

4. Clinical trial functional service partnership (FSP) services are gradually maturing, which might become the future trend.

According to our analysis, the top-tier multinational companies are increasingly outsourcing new drug development services to CROs (contract research organizations) through the FSP model. FSP services, such as PPD™ Functional Service Partnership solutions, could be better equipped to meet multinational enterprises’ needs to develop new drugs, and it will become an important model for clinical operations of new drugs in the future.

This dovetails with the global trend of FSP outsourcing for multinational enterprises, with no exception in China.

2Avoca research (used average of 2019 and 2020 FSP% mix to determine market size and FSP% mix of outsourcing in 2021.

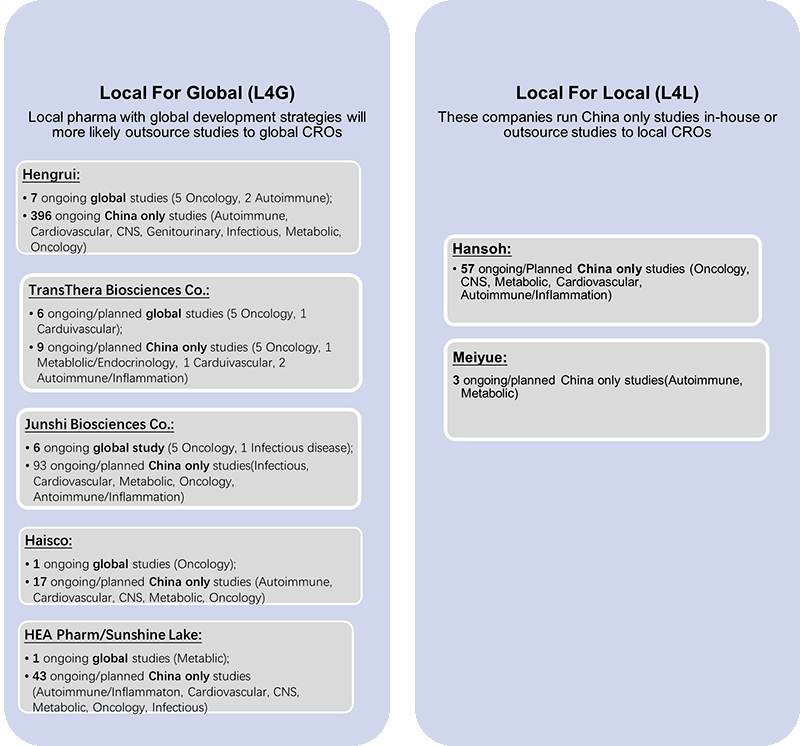

5. More local Chinese companies are pursuing a global research and development strategy and footprint.

Among the top 12 IND applicants in the first quarter of 2022, eight companies were domestic. Only two of the companies developed their products solely in China. The remaining five companies not only developed their products in China, but also ran clinical trials outside China and explored a global development footprint.

Drug developers should consider incorporating China when considering clinical trial strategy and regional selection.

With continued regulatory reform, policy support and encouragement for innovative new drugs, China’s drug R&D activities have boomed in recent years. This is reflected in our analysis of significant quantitative and qualitative change in the first quarter of 2022. After China joined The International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), its integration with the international market has further deepened, and more Chinese companies are exploring international development and expanding their global footprint.

For sponsors considering a global pipeline or global trials strategy, China should be an important consideration, as it’s fast developing in both regulatory reform and the new drugs market.