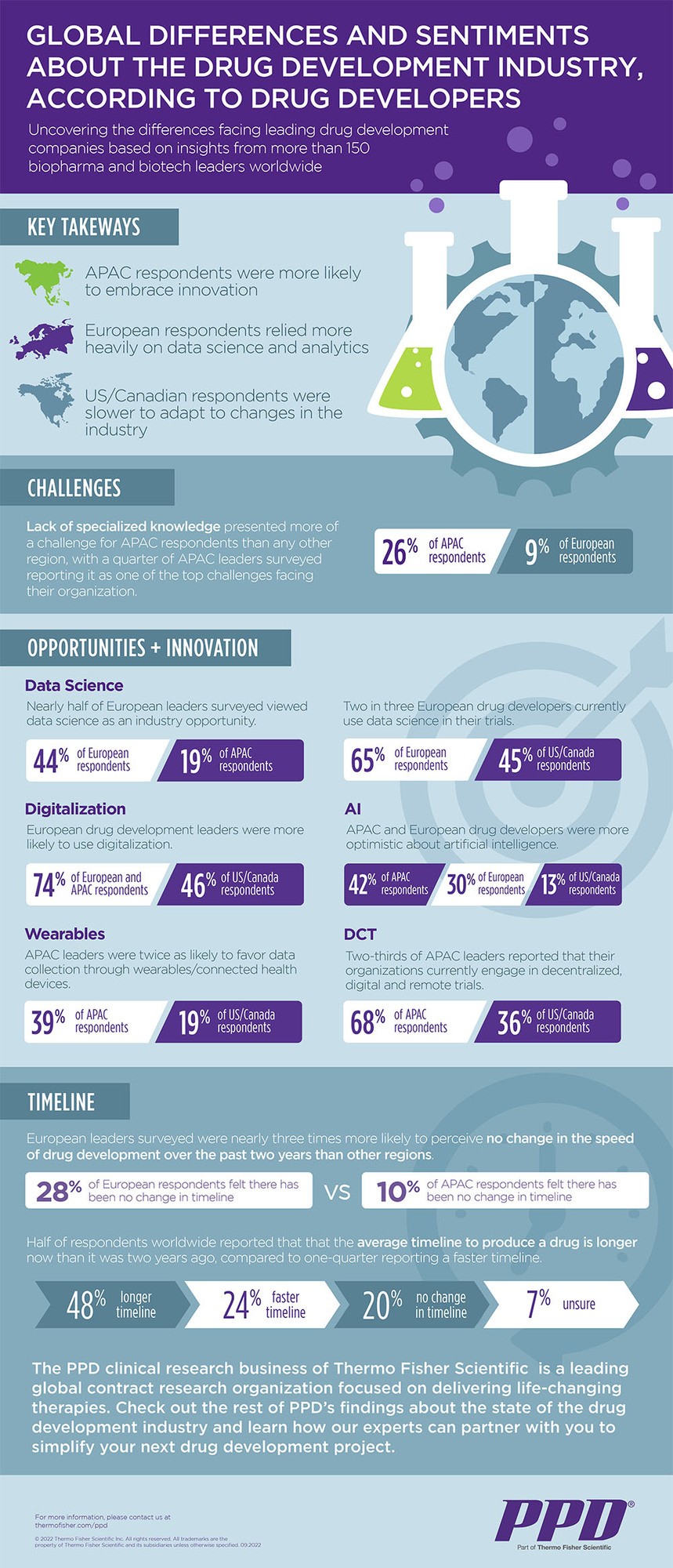

Global Differences and Sentiments About the Drug Development Industry

Uncover the differences facing leading drug development companies based on insights from more than 150 biopharma and biotech leaders worldwide.

The PPD clinical research business of Thermo Fisher Scientific surveyed more than 150 decision-making leaders at pharmaceutical and biotech companies around the globe to assess trends in drug discovery and development.

The report, R&D Trends in Pharma and Biotech, reflects on today’s challenges and opportunities in bringing new therapies to market. Respondents shared the therapeutic areas in their pipelines, the barriers they face in bringing drugs to market, the innovations they’re pursuing and the lingering effects of COVID-19.

Discover the global differences facing leading drug development organizations, based on insights we collected in our 2022 industry report.

Responses to the survey uncovered statistically significant, geography-based differences in the industry’s use of technologies and innovation.

Key takeaways:

- European drug developers are more readily turning to data science and analytics than their global counterparts. Nearly half of European respondents view data science as an industry opportunity, compared with about one in five respondents based in APAC. Today, two in three European respondents use data science in their trials, as compared with roughly two in five respondents in the U.S./Canada.

- APAC drug developers are more likely to embrace innovation, such as artificial intelligence and data collected from wearables, compared to their counterparts in U.S./Canada.

- APAC respondents are also engaging in decentralized, digital and remote trials nearly twice as often as respondents in North America — 68% compared to 36% of U.S./Canada respondents.

As drug developers face a season of growth and change for the field, these geographic differences in sentiment and strategy illuminate opportunities across the spectrum of clinical trial development and execution.

Partnering with a clinical research organization that understands the shifting drug development landscape and has a global perspective will propel sponsors forward in a year that our research predicts will bring both change and opportunity.